The annual iPhone day has come and gone.

Apple on Friday launched the latest generation of its most popular devices: The iPhone 16, Watch Series 10 and AirPods familyThe new models will hit stores on September 20, and as usual, the tech giant generated a lot of anticipation for their launch.

At its flagship store on Fifth Avenue in New York, top Apple executives, including Chief Executive Tim Cook, greeted excited customers, many of whom waited in line for hours to be the first to get their hands on the new devices.

One executive, Deirdre O’Brien, Apple’s senior vice president of retail, was especially enthusiastic on Friday.

“We’re living in the moment, really. And you can feel the energy, and it’s hard to sleep the night before,” he told TPG in an exclusive interview on the day of the release. (He got about four hours of sleep Thursday night, he told TPG.)

Pre-orders for the new devices began on Friday, September 13, just a few days after the company’s special keynote event, during which the tech giant unveiled its latest products, including a New AirPods model.

From upgrades to cameras, battery and durability to noise cancellation on entry-level AirPods, the latest devices will likely appeal to many consumers, especially those who are always on the go.

And if you’re thinking about splurging on new tech, O’Brien shared some tips for maximizing your spending. Here’s everything you need to know.

Make the purchase

When it comes time to purchase a new Apple device, O’Brien says no store is better equipped than Apple’s own retail stores.

Daily Bulletin

Reward your inbox with TPG’s daily newsletter

Join over 700,000 readers for breaking news, in-depth guides, and exclusive deals from TPG experts.

Apple employees know every detail of new products, and it’s that “connection” and “ability to educate our customers” that makes for a better shopping experience, he said. O’Brien noted that the stores offer a comprehensive experience that he believes is better than that offered by third-party resellers.

Apple Store employees (or specialists, as they’re called) will answer questions, set up your device (including activating your cellular service), and even offer helpful tips and tricks in what the company calls “Today at Apple” sessions.

Since iPhone demand typically seems to outstrip supply when a new product is launched, O’Brien suggests that customers can tip the scales in their favor by monitoring online availability of their preferred devices and then placing an in-store pickup order to reserve the device they want.

Of course, many other stores sell Apple technology; for example, you can purchase an iPhone from the carrier of your choice (AT&T, Verizon either T-Mobile) or through third-party providers such as The best buy and Walmart.

Sometimes, purchasing an iPhone through a third party can be a better option than buying directly through Apple, especially during limited-time promotions, so you’ll want to compare your options before making a decision.

Exchange options

New iPhones certainly aren’t cheap, and O’Brien’s top tip for making the purchase much more affordable is to trade in your current device.

“First of all, you have that courage,” O’Brien said of the Apple Exchange “Secondly, it’s great for the environment, and the environment is a core value for us at Apple.”

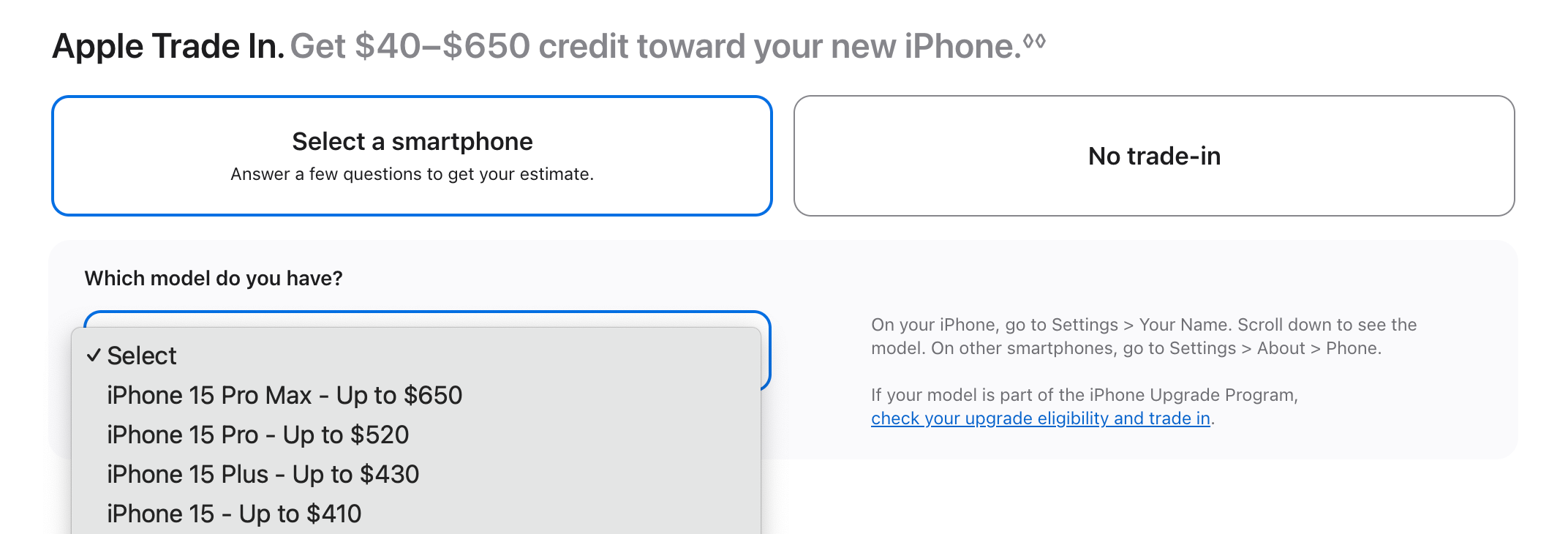

If you have a spare device, Apple will offer you credit (or a gift card) toward the purchase of a new phone. Credits range from $40 for the iPhone 7 Plus (2016) to $650 if you trade in last year’s iPhone 15 Pro Max.

You’ll need to make your purchase directly through Apple to take advantage of this particular trade-in offer, though some third-party sellers have similar promotions available.

Of course, you’ll always want to read the terms and conditions of any exchange offer.

Shopping portal bonuses

While O’Brien shared some tips, there are other things to keep in mind when purchasing new devices to maximize their value.

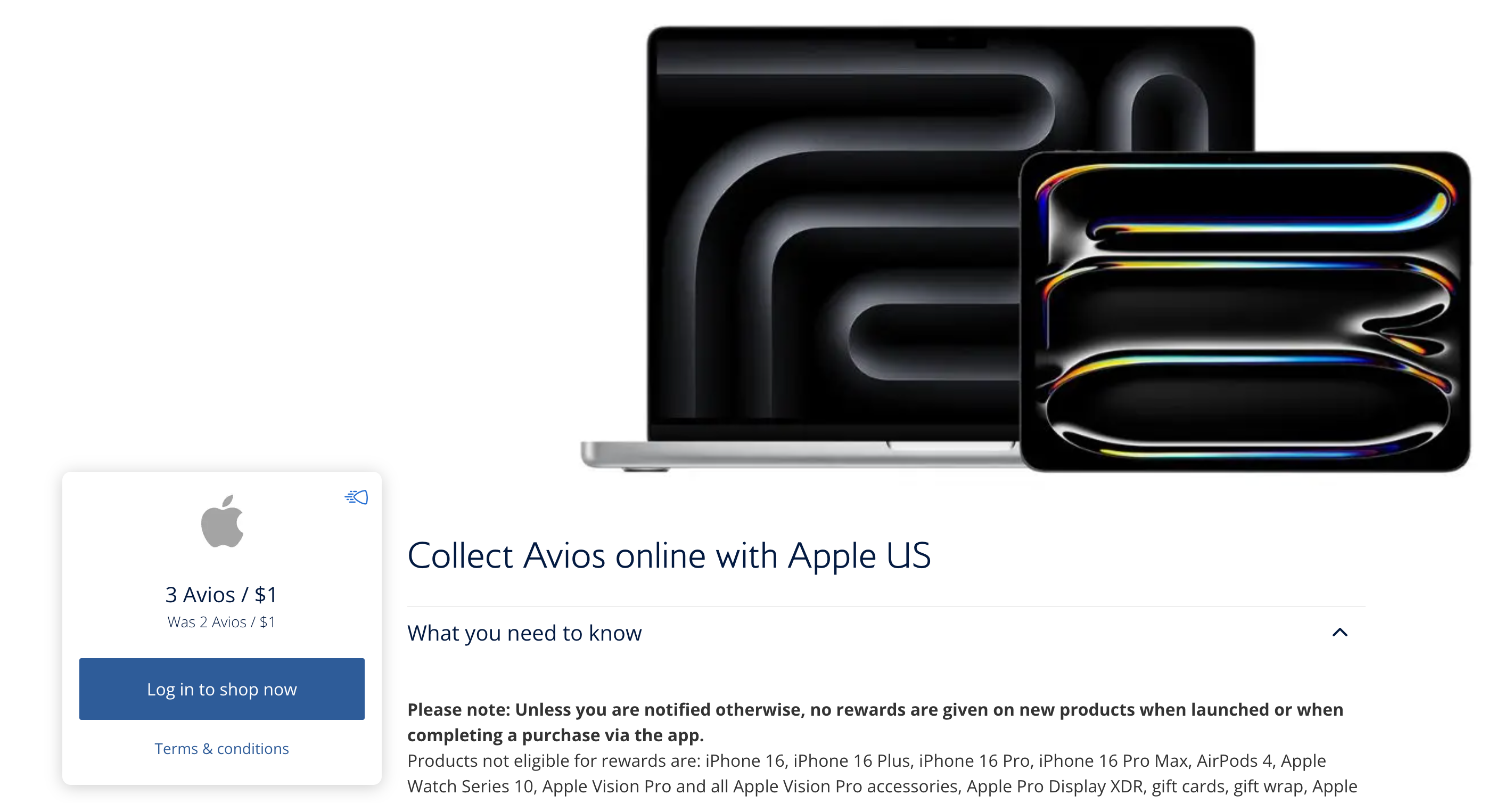

First of all, check Shopping portal bonusesIf you start your purchase process on one of these portals, you will be redirected to buy the device directly from Apple, but you will earn more points or miles. Some devices are not eligible for portal bonuses immediately after launch, though this is something to keep in mind if you decide to make the purchase at a later date.

I would recommend using a Shopping portal aggregator as Cashback Monitor to easily identify the highest return.

Which cards to use?

The next big question is which credit card to use for your purchase.

In O’Brien’s mind, that’s the Apple Card.

“You can always use an Apple Card, and the card comes with a lot of great features,” he said.

The Apple Card isn’t the worst option, as you can take advantage of an interest-free monthly payment plan and get 3% cash back if you purchase directly through Apple. Apple Card information has been collected independently by The Points Guy. The card details displayed on this page have not been reviewed or provided by the card issuer.

But it’s not necessarily the best option to maximize rewards and extended warranty coverage.

Historically, I have made my Apple purchases with The Platinum Card® from American Express. Although you will only win 1 American Express Membership Rewards point (worth 2 cents, according to TPG’s September 2024 report) ratings) for every dollar spent, the card is included purchase protection It’s a great insurance policy if I end up breaking or losing my iPhone.

Additionally, Amex offers continuous mobile phone protection with the Platinum Card, making this card my top choice for iPhone purchases.

Ultimately, given the high cost of Apple’s latest devices, I would focus on Cards that offer purchase protection and extended warranty benefits rather than those that offer the highest return. Other top purchase protection options include:

| Card | Maximum coverage amount (per item or claim) |

Maximum coverage amount (per card or account) | Duration of coverage (days) | Apple Purchase Profit Rate | Annual fee |

|---|---|---|---|---|---|

| American Express® Gold Card* | $10,000 per item (or $500 per event in case of natural disasters) | $50,000 per card, per calendar year | 90 | 1 Membership Rewards point per dollar | $325 (see rates and fees) |

| Capital One Venture X Rewards Credit Card | $10,000 per claim | $50,000 per account | 90 | 2 Capital One miles per dollar | $395 |

| Ink Business Cash® Credit Card | $10,000 per claim | $50,000 per account | 120 | 1% cash back | $0 |

| Blue Cash Everyday® Card from American Express* | $1,000 per item (or $500 per event in case of natural disasters) | $50,000 per card, per year | 90 | 3% cash back on online retail purchases in the US, up to $6,000 in purchases per year (then 1%) | $0 annual fee (see rates and fees). |

| Pursue Flex® Freedom | $500 per claim | $50,000 per account | 120 | 1% cash back | $0 |

* Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more information. Policies are underwritten by AMEX Assurance Company.

Protect your investment

Apple and other third-party retailers sell AppleCare+ and other exclusive warranties. These might be worth considering, especially in the case of accidental damage to non-iPhone devices, but savvy consumers with the right credit card may be covered for damage to their iPhones.

Today, some of our top-recommended credit cards also offer ongoing cell phone protection, as long as you pay your carrier bill. with an eligible card that offers protection against loss and damageThat alone could cover an annual fee if you end up damaging your device.

Personally, I would recommend using either one. American Express Platinum Cardhe Pursue flexible freedom or the Capital One Venture Xall of which offer both purchase protection and cell phone protection benefits.

| Card | Coverage/deductible | Notable Exclusions | Mobile phone bill profit rate | Annual fee |

|---|---|---|---|---|

| Ink Business Preferred® Credit Card | Up to $1,000 per claim, with a maximum of three claims per 12-month period (with a $100 deductible per claim) | Cosmetic damage that does not affect the phone’s ability to function; lost phones | 3 Chase Ultimate Rewards points per dollar* | $95 |

| The American Express Platinum Card** | Up to $800 per claim, with a maximum of two claims per 12-month period (with a $50 deductible) | Cosmetic damage that does not affect the phone’s ability to function; lost phones | 1 Amex Membership Rewards point per dollar | $695 (see rates and fees) |

| Pursue flexible freedom | Up to $800 per claim, with a maximum of two claims valued at $1,000 per 12-month period (with a $50 deductible) | Cosmetic damage that does not affect the phone’s ability to function; lost phones | 1 Chase Ultimate Rewards point per dollar | $0 |

| Capital One Venture X Rewards Credit Card | Up to $800 per claim, with a maximum of two claims valued at $1,600 per 12-month period (with a $50 deductible) | Cosmetic damage that does not affect the phone’s ability to function; lost phones | 2 Capital One miles per dollar | $395 |

*Earn 3 Ultimate Rewards points for every dollar you spendon the first $150,000 in combined purchases each account anniversary year in the categories of travel, shipping purchases, internet, cable and phone services, and advertising purchases on social media sites and search engines.

**Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for more information. Policies are underwritten by New Hampshire Insurance Company, an AIG company.

Compliance with minimum spending

Finally, another consideration would be to time your splurge with the opening of a new card. This way, you’ll be that much closer to meeting the minimum spending requirement to earn a significant sign-up bonus. One of our top picks right now is the Chase Sapphire Preferred® Cardoffering 60,000 bonus points after spending $4,000 on purchases in the first three months of account opening.

You can find a complete list of the best deals herePlease note that not all of these cards include purchase protection and extended warranty benefits, so if you want to prioritize coverage over points, see the table above.

Related reading:

For Amex Platinum Card rates and fees, click here. here

For Amex Gold Card rates and fees, click here. here

For Blue Cash Everyday rates and fees, click here. here